Notwithstanding the surplus of Nor’Easters on the east coast and a “River of Rain” on the west, the calendar says it’s spring and consumers are absolutely dying to do something in their gardens.

So, what are your exciting anticipation points this spring?

- A stronger economy increasing the average spend?

- Droves of excited new consumers as Millennials finally get gardening?

- The continued surge in sales of houseplants, succulents and other millennial “stuff”?

- A shortage of some plants as landscapers vacuum up supplies?

- On-line sales and advice challenging your status quo?

Nope. If I ask that question to owners of garden retail stores the immediate response is one, ever-present word or subject – Labor. “How are other companies you know finding people? What are they paying or promising? How are they keeping them?”

This year’s garden retail business story is all about Labor, or the lack of it.

The short term answers for this year include paying more than you think the job is worth, offering several part-time positions for each full time position, end-of-season bonuses, raising prices to cover increased labor, reducing some categories that just soak up labor hours and quite frankly, doing without.

Time to Change the Model

I think this is the kick in the seat the industry needed. For years the garden business has depended on finding thousands of educated dedicated people to work long and hard for average earnings because they loved the product and the process. The “secret sauce” of the business model was that our work force held the essential information for consumers who loved the end result of gardening, but were fearful of failure. Householders had to come to our stores if they wanted assurance and success.

Well, no more. Now that consumers can source, research and buy so much on-line, retail employees are no longer the first-providers of crucial how-to information. That powerful position is gone forever (and it was powerful).

The role of retail teams has changed to one of validation or correction of what consumers have already learned. Employees are now in effect the curators (I hate this word, sorry) of all that on-line information, the selectors of all those products and mentors of all those on-line promises. They are now there to advise which particular soil exists in this area, what the best hanging basket plant is in their location, how many pounds of potatoes you realistically can expect from those cute fingerling things.

Of the three bedrock principles of garden retailing (Quality, Selection and Service), Quality is now a given while Selection is now universal. Only Service can be a unique differentiator, but it can’t be hand-holding service any more.

Silent Running

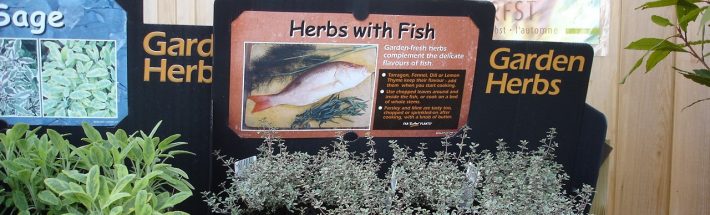

This role still takes education, professionalism and passion too, but much of it can be delivered by “silent selling” on-site with re-thought merchandising and signage and You-Tube type videos. All of which means a very different use of those valuable employees but in the longer term requires less on-site educated year-round help.

This might seem like sacrilege to the traditionalists but consumers are so used to (and some even truly PREFER) self-service on-line from Amazon to car insurance that even a partial hand-holding garden retailer has the competitive advantage. The retailer still holds the cards with credible, knowledgeable employees helping where necessary, still local, still passionate.

So I think we are finally moving to a model where shoppers can browse, read, learn, view and buy “silently” or be helped by a few very credible and helpful people on patrol – a bit like one of my favorite stores, REI.

This eventually means we will have less employees by design… but they will be making more money (and that must be nothing but “a good thing” as someone once said).

But for this year, what are your short-term tactics to get you over the labor challenge? Let us know in the comments: sharing is caring!

Photo Credit: taken by Ian at TreeHouse Store in Austin TX

Recent Comments