As some readers may know, we launched our new online project (The 5 Numbers Project at Your MarketMetrics) to build a national database for independent garden retailers this year, and have been amazed at the response in just a few months. We already have 56 garden center companies (and counting!), representing total retail sales of more than $330 million reporting their five monthly metrics. (Enrollment window is open now so new participants still have time to enter their historical data before spring 2020 hits!)

The detailed resulting trends data is only available for participating companies, but … to pique your interest, we CAN share some observations that might just make you go “Hmmm…”. We know that just a few months’ data doesn’t make a national take-it-to-your-loan-officer trend, but we can still point to a few aspects of the industry that you might like to chew on with your team!

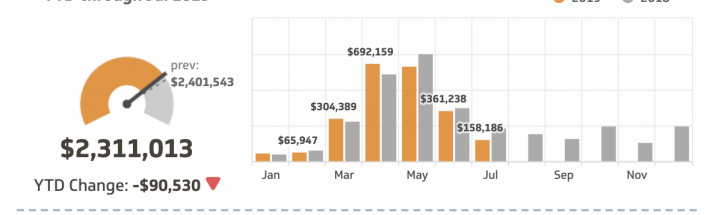

Hmmm #1. Most regions of the country had a decent year according to Sales $s or “topline” … but is that topline growing faster than the total costs of being in business – i.e. the cost of just opening the door every day? Do you know your daily cost of being in business and are your sales rising faster? Hmmm…

Hmmm… #2. Customer Count (register rings/tickets) has increased for most GCs in 2019, but did yours rise a) faster than sales or b) slower than sales? The remedy for a) is very different to the one for b) and it’s very hard to attack both at once! Which is your priority? Do you have the resources to address it for 2020? Hmmm…

Hmmm… #3. Average Sale Per Customer (including increased retail prices) is NOT keeping up with consumer spending, despite full employment and rising personal debt. Ultimately, we’re losing “wallet share”. Many GCs are selling LESS units or products, are you? If so, are your Gross Margin $s increasing fast enough to compensate? Hmmm…

Hmmm… #4. Growth in Gross Margin $s is a mixed bag this year; GM “leakage” is a thing! If GM$s decrease, can you cut other costs accordingly? Good luck with that! Inventory and labor take 65% to 75% of Sales $s, so what really matters is what’s left after you’ve bought your stuff and paid your people – what we call “Gap $s” (Gross Margin after Labor). If your Gap $s are less than last year, you’re going backwards, I don’t care what the topline sales tell you! Hmmm…

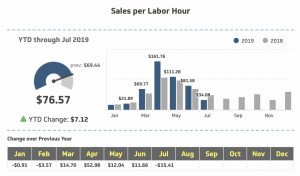

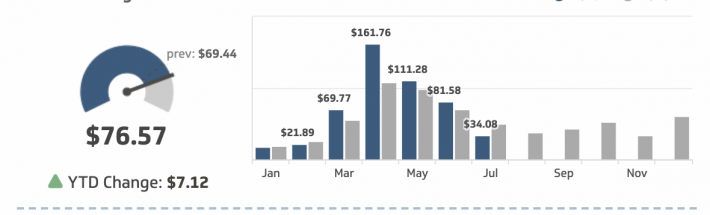

Hmmm… #5. The “Secret Sauce” in The 5 Numbers Project is measuring Labor Hours as well as Labor $s so we can track trends in your Labor Productivity, and the range is HUGE. Some GCs are twice as productive as their neighbors! What is a “GREAT” productivity number? How does yours compare? Is your Labor Productivity rising faster than the cost of Labor? It better be! Hmmm…

We’ve been using these metrics for over 20 years with clients, but it always amazes me how many crucial business decisions and follow-up strategies can be arrived at from just 5 monthly numbers: Sales $s, Customer Count, G Margin $s, Labor $s and Labor Hours.

Would you like to join us, making 2020 the year that you focus on improving your business’ productivity and profitability? The 5 Numbers Project (T5NP) allows you to see in simple-at-a-glance charts how your business is doing monthly and YTD and then compares your performance with your anonymous industry peers both by region and company size. These simple visuals empower your TEAM to make improvements and really “move the needle” as you measure what matters. Many of the GC industry’s “A List” are already onboard, and we’d love you to you join us for the T5NP journey!

(** The fine print: You can learn more about pricing at the T5NP link, but onboarding is a one-time fee of $895 to get your own personal dashboards built (and $149/month thereafter.) We also have some partnerships with buying co-ops, like Master Nursery Garden Centers, that can get you some price discounts!)

Recent Comments