Between 65% and 80% of all the money that independent garden retailers receive as Sales Dollars is spent within the next few weeks or months on just two aspects of running the business: Inventory and Labor. So yes: Labor Dollars is a BIG important number!

The range of labor costs as a percentage of sales in all types of retail can range from the low single digits of a warehouse “club” to the high 20%s, even the low 30%s in a lavishly, full service, up-scale store (the sort of place you have to ask them to let you in…). The range in a typical independent or local garden retailer can be from 15% of sales to the high 20s, depending on the service model and the competency of the management.

A Burden Or An Investment?

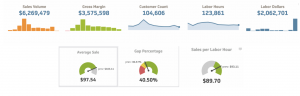

But as you’ve heard me say, dollars pay the bills, not percentages, so let’s look at what that means in real numbers. When we talk about the labor bill (and when we track it in the 5 Numbers Project), we are taking about the whole cost of labor, not just the wage the employee gets. The “human” costs of employing others (sometimes called “Burden”) are unknown to many employees. Well, unless someone told them, how would they know anyway? I didn’t when I was an employee.

This labor total includes the actual wage plus all payroll taxes and fees, plus the employer’s contributions to things like FICA, FUTA, Workman’s Comp, Health Insurance, Vacation Pay or PTO, training, conference travel and even uniforms. If it is part of having human beings working at your company, we include it. Depending on what state you operate in, this can add up to 30% or more to the hourly cost, making a $15 an hour employee cost the company more like $20. I just heard from a client this week that their health insurance alone now works out at an extra $3.50 an hour (but their poinsettia prices haven’t gone up in years…)

So the rise in labor dollars is something we are closely following, especially in a good economy when employees have some leverage to bargain with. Just from watching the trends of this one number, questions emerge: Is our rise in labor dollars more or less than our rise in what pays for it, i.e., Sales Dollars? Are Gross Margin dollars going up quicker than Labor Dollars and if not, how do we make that happen?

Making Informed Decisions

When Labor Dollars are a focus of management, buyers who discover that next “killer” item, can now ask themselves if the extra labor cost associated with this new product will negate all the extra margin dollars it could bring in. That’s a “hmmm…” factor. (It might also be a good negotiating point with the supplier!)

When you closely track your labor costs, it almost becomes second nature to think of the value of the task the team are currently doing. Are we matching employee costs to the value of the task? Do we have employees costing $24 an hour doing tasks that could be done by someone costing less, and if so – is there an employee growth opportunity? I know a manager who once calculated that, because of their disorganized receiving system, the labor cost of unloading a truck was about the same as the Gross Margin dollars in that load! (That’s an Arrrggghhh!)

So, as you can tell, we do watch all these numbers very closely. As Labor Dollars are the second biggest cost after Inventory (and exponentially more than the marketing budget!), we especially track the trends and changes in this one.

Click here to learn more about The 5 Numbers Project: a national initiative to create valuable benchmarking & visual dashboards that will increase profitability for independent garden centers. And stay tuned for the last of the 5 numbers – Labor Hours – next week.

Recent Comments